Installa l'app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Nota: This feature may not be available in some browsers.

Stai usando un browser molto obsoleto. Puoi incorrere in problemi di visualizzazione di questo e altri siti oltre che in problemi di sicurezza. .

Dovresti aggiornarlo oppure usare usarne uno alternativo, moderno e sicuro.

Dovresti aggiornarlo oppure usare usarne uno alternativo, moderno e sicuro.

Apple Inc. [NASDAQ:AAPL] vol. 8

-

Nuovi Equity Protection su azioni e materie prime con rendimenti all’emissione fino a 35%

Nuovi Equity Protection su azioni e materie prime con rendimenti all’emissione fino a 35%

Societe Generale rende disponibili su Borsa Italiana (SeDeX) 10 Equity Protection Certificate (con Cap) su azioni e materie prime.

Per continuare a leggere visita questo LINK -

Trading Day 19 aprile Torino - Corso Gratuito sull'investimento

Trading Day 19 aprile Torino - Corso Gratuito sull'investimento

Migliora la tua strategia di trading con le preziose intuizioni dei nostri esperti su oro, materie prime, analisi tecnica, criptovalute e molto altro ancora. Iscriviti subito per partecipare gratuitamente allo Swissquote Trading Day.

Per continuare a leggere visita questo LINK

Più opzioni

Chi ha risposto?eternauta

Novacula Occami

- Registrato

- 9/7/12

- Messaggi

- 1.979

- Punti reazioni

- 164

SAN FRANCISCO (MarketWatch) —

Apple Inc. investors have had a good news/bad news kind of week so far, with a very optimistic report on expectations that the next iPhone will indeed have a larger screen, countered by negative details emerging from a new book on the company.

Brian Marshall, an analyst with ISI Group, wrote in a note over the weekend that the next iPhone will have the larger screen size now standard in rival smartphones. He predicted that this “motherlode of upgrades” with two new larger screen iPhones this summer, will help it regain some of the market share lost to Android phones. Many “Android switchers,” will come back, he wrote.

Already Apple has come out swinging about the thesis behind “Haunted Empire,” which posits that the company’s best days are behind it. Chief Executive Tim Cook gave a statement to CNBC Tuesday. “This nonsense belongs with some of the other books I’ve read about Apple,” Cook told CNBC. “It fails to capture Apple, Steve, or anyone else in the company....I am very confident about our future. We’ve always had many doubters in our history. They only make us stronger.”

Probably among the most interesting details to emerge for investors is Kane’s reporting that Jobs appeared to have had an about-face on Apple’s plans to shake up the TV business.

According to her book, which also takes a view that Apple’s best days are behind it, at the company’s “Top 100” meeting of executives and employees at an off-site resort, someone asked Jobs if Apple was going to conquer the TV business next. “No,” Jobs said, according to Kane’s book, published by Harper Collins, part of News Corp. which also is the owner of MarketWatch and The Wall Street Journal. “TV is a terrible business. They don’t turn over and the margins suck.”

Investors have already been dealing with concerns that Apple TV may not be the product that some on Wall Street had hoped for, one that would upend the television business with an easy-to-use system and set-top box integrating both web content and broadcast TV. In the 2011 biography “Steve Jobs” by Walter Isaacson, Jobs tells his biographer that he “finally cracked” TV. Since the book was released, many have held out hopes that Apple TV, currently a set-top box, would also include an Apple-designed high definition TV and integration with all Apple devices.

But it is now years since that statement was made to Isaacson. Still no TV has emerged beyond the company’s set-top box, and content deals with the cable companies have reportedly been tough to negotiate. The impending merger between Comcast Corp. and Time-Warner Cable Inc. is also believed to be bad for Apple’s efforts to get more ambitious programming on its box. Apple does not comment on unannounced products.

Now, with Kane’s book reporting Jobs’s additional comments about TV, investors are back to square one, looking ahead to the iPhone as the potential driver. They have also been speculating about a potential **** Tracy-like watch called the iWatch and more recently CarPlay, a feature in Apple’s mobile operating system that integrates the iPhone with the dashboard of new cars in the works from General Motors, Mercedez-Benz and Honda.

“While new product introductions such as CarPlay and a potential new iWatch or iTV are important for ecosystem development and brand-building, iPhone remains the critical driver of the story at about 60% of gross profits,” Marshall wrote in his note on Sunday. “We believe the stock is not reflecting solid sales/EPS upside potential from the upgrade cycle.”

So until Apple releases anything in the tantalizing arena of wearable computing or any other arena, the iPhone will dominate investor psychology.

Apple Inc. investors have had a good news/bad news kind of week so far, with a very optimistic report on expectations that the next iPhone will indeed have a larger screen, countered by negative details emerging from a new book on the company.

Brian Marshall, an analyst with ISI Group, wrote in a note over the weekend that the next iPhone will have the larger screen size now standard in rival smartphones. He predicted that this “motherlode of upgrades” with two new larger screen iPhones this summer, will help it regain some of the market share lost to Android phones. Many “Android switchers,” will come back, he wrote.

Already Apple has come out swinging about the thesis behind “Haunted Empire,” which posits that the company’s best days are behind it. Chief Executive Tim Cook gave a statement to CNBC Tuesday. “This nonsense belongs with some of the other books I’ve read about Apple,” Cook told CNBC. “It fails to capture Apple, Steve, or anyone else in the company....I am very confident about our future. We’ve always had many doubters in our history. They only make us stronger.”

Probably among the most interesting details to emerge for investors is Kane’s reporting that Jobs appeared to have had an about-face on Apple’s plans to shake up the TV business.

According to her book, which also takes a view that Apple’s best days are behind it, at the company’s “Top 100” meeting of executives and employees at an off-site resort, someone asked Jobs if Apple was going to conquer the TV business next. “No,” Jobs said, according to Kane’s book, published by Harper Collins, part of News Corp. which also is the owner of MarketWatch and The Wall Street Journal. “TV is a terrible business. They don’t turn over and the margins suck.”

Investors have already been dealing with concerns that Apple TV may not be the product that some on Wall Street had hoped for, one that would upend the television business with an easy-to-use system and set-top box integrating both web content and broadcast TV. In the 2011 biography “Steve Jobs” by Walter Isaacson, Jobs tells his biographer that he “finally cracked” TV. Since the book was released, many have held out hopes that Apple TV, currently a set-top box, would also include an Apple-designed high definition TV and integration with all Apple devices.

But it is now years since that statement was made to Isaacson. Still no TV has emerged beyond the company’s set-top box, and content deals with the cable companies have reportedly been tough to negotiate. The impending merger between Comcast Corp. and Time-Warner Cable Inc. is also believed to be bad for Apple’s efforts to get more ambitious programming on its box. Apple does not comment on unannounced products.

Now, with Kane’s book reporting Jobs’s additional comments about TV, investors are back to square one, looking ahead to the iPhone as the potential driver. They have also been speculating about a potential **** Tracy-like watch called the iWatch and more recently CarPlay, a feature in Apple’s mobile operating system that integrates the iPhone with the dashboard of new cars in the works from General Motors, Mercedez-Benz and Honda.

“While new product introductions such as CarPlay and a potential new iWatch or iTV are important for ecosystem development and brand-building, iPhone remains the critical driver of the story at about 60% of gross profits,” Marshall wrote in his note on Sunday. “We believe the stock is not reflecting solid sales/EPS upside potential from the upgrade cycle.”

So until Apple releases anything in the tantalizing arena of wearable computing or any other arena, the iPhone will dominate investor psychology.

- Registrato

- 20/6/09

- Messaggi

- 27.787

- Punti reazioni

- 347

by Lawrence Lewitinn

14 hours ago

While the market was down on Monday, one stock bucked the trend on news of a potential big deal and a potential big screen: Apple.

The tech giant is reportedly talking to Comcast [parent company of NBC] about a deal which could improve picture quality for users of Apple TV's set-top box.

.....

http://finance.yahoo.com/blogs/talking-numbers/why-apple-could-see--650-soon-232608378.html

14 hours ago

While the market was down on Monday, one stock bucked the trend on news of a potential big deal and a potential big screen: Apple.

The tech giant is reportedly talking to Comcast [parent company of NBC] about a deal which could improve picture quality for users of Apple TV's set-top box.

.....

http://finance.yahoo.com/blogs/talking-numbers/why-apple-could-see--650-soon-232608378.html

eternauta

Novacula Occami

- Registrato

- 9/7/12

- Messaggi

- 1.979

- Punti reazioni

- 164

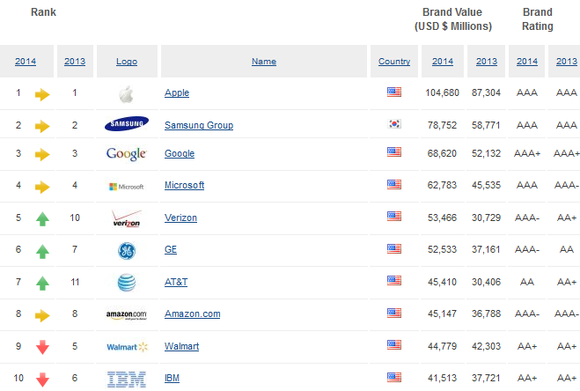

Like humans, a company is often worth more than the sum of its parts. It is not uncommon for a company to be valued for more than it is worth on the books. Goodwill refers to the intangible value of a company -- things like patents, copyrights, and royalties are considered intangible assets. In an acquisition, if the acquiring company pays more than the company is worth on the books, also known as "book value," the difference is considered goodwill. One component of goodwill is brand, and Brand Finance is a brand valuation consultancy that helps companies determine their brand worth. The firm recently published a study of the most valuable brands in the world for 2014.

Ranking methodology

Brand Finance used the Royalty Relief method to determine the value that a company would pay for licensing its own brand. It applied a Brand Strength Index, or BSI score, which measured things like financial performance, sustainability, and even emotional connection. Brand-specific revenue was then calculated by estimating the percentage of revenue attributable to each brand, and the royalty rate was applied to forecasted revenue.

Who made the list?

Apple (NASDAQ: AAPL ) tops the list for the third year in a row with a brand value of $104.7 billion; Samsung (NASDAQOTH: SSNLF ) came in second with a brand value of $78.8 billion, followed by Google (NASDAQ: GOOG ) at $68.6 billion.

Among the three, Google comes in first for stock price returns, followed by Apple, then Samsung. Samsung actually has a negative one-year price return. Clearly, brand isn't everything when it comes to investment decisions. Like GE, Samsung has the ability to establish a brand presence in several industries, but the bulk of the value for the brand, according to Brand Finance, is derived from the consumer electronics division.

IBM has come down considerably in rank this year, from No. 6 to No. 10, and Wal-Mart -- the only non-tech company on the list -- also lost ground, dropping from No. 5 to No. 9. Verizon and AT&T made the biggest leaps up, with Verizon climbing from No. 10 to No. 5 and AT&T climbing from No. 11 to No. 7.

While Apple owns the most valuable brand, the consultancy has another measure of power, or brand strength, that is assigned a rating of AAA+ or lower; AAA+ is the highest rating. Accordingly, Ferrari is the world's most powerful brand. David Haigh, Chief Executive, had this to say:

The prancing horse on a yellow badge is instantly recognizable the world over, even where paved roads have yet to reach. In its home country and among its many admirers worldwide Ferrari inspires more than just brand loyalty, more of a cultish, even quasi-religious devotion, its brand power is indisputable.

Other brands awarded a AAA+ rating include Google, Coca-Cola, Disney, and Rolex.

When comparing the difference between Apple's value and it's more powerful counterparts, Haigh points to Apple's ability to pull value out of the brand, saying:

Apple also has a powerful brand, rated AAA by Brand Finance. However what sets it apart is its ability to monetize that brand. For example, though tablets were in use before the iPad, it was the application of the Apple brand to the concept that captured the public imagination and allowed it to take off as a commercial reality.

While Apple has dominated the brand value charts for three years, Samsung, the only company on the list not based in the U.S., is slowly gaining ground. This South Korean behemoth's brand value increased from $59 billion last year to $79 billion in 2014.

Netflix debuted on the list for the first time at 468th. The company's brand value increased 93% to $3.2 billion last year.

Takeaway

The value of goodwill is directly connected to the value of the company and a large component of goodwill is the value of the brand. If a company's brand is tainted, the stock price will fall, and vice versa. Brand isn't everything, especially for companies that leverage volume over price, like discount retailers. Therefore, brand is important when assessing risk or credibility, but the degree to which it may affect the stock price depends on the company's overall sales strategy.

Ultima modifica:

eternauta

Novacula Occami

- Registrato

- 9/7/12

- Messaggi

- 1.979

- Punti reazioni

- 164

sostiene Arie Goren @seekingalpha

Summary

Apple is a rare combination of good value and strong growth dividend stock.

The current price offers an opportunity to initiate or add to positions in AAPL shares.

All seven analysts who have the highest 5-Star rating, according to Tip Ranks, are recommending the stock.

I find Apple Inc. (AAPL) stock to be providing a rare combination of value and growth. While the S&P 500 index has risen 30.2% since the beginning of 2013 and the Nasdaq Composite Index has risen 40%, AAPL stock has done nothing at the same period, only a 1.3% rise, but in my opinion, it has plenty of room to move up. Furthermore, Apple returns value to its shareholders through dividend payments and stock buybacks. In this article, I will explain why Apple stock is a remarkably promising long-term investment.

Apple has a market cap of about $481 billion, the largest among all the companies trading on U.S. markets, and its stock is extremely popular. 2,737 institutions are holding the stock, more than any other stock, and many individuals have put some of their money in this stock. We can get an idea of the popularity of the stock by checking Seeking Alpha's number of people who get real-time alerts on the stock; 231,071 in the case of AAPL, this compared to 131,952 on Google Inc. (GOOG), 82,033 on Facebook, Inc. (FB), 74,053 on Microsoft Corporation (MSFT), and 59,089 people who get real-time alerts on Intel Corporation (INTC).

An investor who considers buying the stock now and is looking for information and analysis about AAPL stock might be confused by the excessive information, most of it contradictory, and by the varied analyst opinions about the stock. On one hand, a new book "Haunted Empire", written by former Wall Street Journal reporter Yukari Iwatani Kane, offers a critical assessment of how Apple has fared in the years since the death of Steve Jobs. On the other hand, according to Carl Icahn, who owns 4.7 million AAPL shares, "Apple remains a no brainer as a long-term investment."

Analyst Opinion

Analysts' opinion is deeply divided; among the fifty-two analysts covering the stock, fifteen rate it as a strong buy, twenty two rate it as a buy, thirteen rate it as a hold, one rates it as an underperform, and one analyst rates it as a sell.

According to Tip Ranks, a website which ranks analysts according to their performance, analysts are wrong 50.2% of the time. According to Tip Ranks, among the analysts covering AAPL stock, there are only seven who have the highest 5-Star rating, and all of them are recommending the stock.

On March 24, Pacific Crest's 5-Star analyst Andy Hargreaves reiterated an outperform rating on Apple stock, and a $635 price target, writing that his "checks" of component suppliers and carrier stores suggests "iPhone unit volume could exceed our estimates of 39.7 million in March and 33.6 million in June." Hargreaves thinks "replacement rates remain extremely strong and that Apple is gaining share of high-end customers."

My Take

Apple has recorded exceptionally strong revenue and EPS growth during the last five years. The average annual sales growth for the past five years was extremely high at 35.45%, and the average annual EPS growth for the past five years was unusually high at 42.44%, only Facebook among S&P 500 tech stocks has recorded combined stronger results; average sales growth of 96.02% and average EPS growth of 64.38%. According to Yahoo Finance, Apple's next financial year forward P/E is very low at 11.60, and the average annual earnings growth estimates for the next 5 years is very high at 21.28%, these give an extremely low PEG ratio of 0.55, only Lam Research (LRCX) among S&P 500 tech stocks has a lower PEG ratio of 0.48 (see my article about Lam Research). The PEG Ratio - price/earnings to growth ratio - is a widely-used indicator of a stock's potential value. It is favored by many investors over the P/E ratio, because it also accounts for growth. A lower PEG means that the stock is more undervalued.

Apple generates lots of cash, its price-to-free-cash-flow ratio is only 14.46, and it returns value to its shareholders through dividend payments and stock buybacks. The company ended the December 2013 quarter with $158.84 billion in cash, equivalents, and long-term investments, and $16.96 billion in long-term debt, or $142 billion in net cash. Apple returned $7.7 billion in cash to shareholders through dividends and share repurchases during the December quarter. AAPL's forward annual dividend yield is at 2.26% and the payout ratio only 29%.

Apple stock is ranked sixth among S&P 500 companies, according to Portfolio123's powerful ranking system "All-Stars: Buffett". This ranking system is based on investing principles of the well-known investor, Warren Buffett, and 15-years back-test has proved that this ranking system is extremely useful.

As a devoted user of Apple products; iPhone, iPad, and iTunes, I believe, in contrast to many doubters, that Apple has not lost its ability to grow, its products are the best in the market, and exciting new products will come out soon. In my opinion, it is now a rare opportunity for a long-term investment in such a great company at a remarkably cheap price.

Summary

Apple is a rare combination of good value and strong growth dividend stock.

The current price offers an opportunity to initiate or add to positions in AAPL shares.

All seven analysts who have the highest 5-Star rating, according to Tip Ranks, are recommending the stock.

I find Apple Inc. (AAPL) stock to be providing a rare combination of value and growth. While the S&P 500 index has risen 30.2% since the beginning of 2013 and the Nasdaq Composite Index has risen 40%, AAPL stock has done nothing at the same period, only a 1.3% rise, but in my opinion, it has plenty of room to move up. Furthermore, Apple returns value to its shareholders through dividend payments and stock buybacks. In this article, I will explain why Apple stock is a remarkably promising long-term investment.

Apple has a market cap of about $481 billion, the largest among all the companies trading on U.S. markets, and its stock is extremely popular. 2,737 institutions are holding the stock, more than any other stock, and many individuals have put some of their money in this stock. We can get an idea of the popularity of the stock by checking Seeking Alpha's number of people who get real-time alerts on the stock; 231,071 in the case of AAPL, this compared to 131,952 on Google Inc. (GOOG), 82,033 on Facebook, Inc. (FB), 74,053 on Microsoft Corporation (MSFT), and 59,089 people who get real-time alerts on Intel Corporation (INTC).

An investor who considers buying the stock now and is looking for information and analysis about AAPL stock might be confused by the excessive information, most of it contradictory, and by the varied analyst opinions about the stock. On one hand, a new book "Haunted Empire", written by former Wall Street Journal reporter Yukari Iwatani Kane, offers a critical assessment of how Apple has fared in the years since the death of Steve Jobs. On the other hand, according to Carl Icahn, who owns 4.7 million AAPL shares, "Apple remains a no brainer as a long-term investment."

Analyst Opinion

Analysts' opinion is deeply divided; among the fifty-two analysts covering the stock, fifteen rate it as a strong buy, twenty two rate it as a buy, thirteen rate it as a hold, one rates it as an underperform, and one analyst rates it as a sell.

According to Tip Ranks, a website which ranks analysts according to their performance, analysts are wrong 50.2% of the time. According to Tip Ranks, among the analysts covering AAPL stock, there are only seven who have the highest 5-Star rating, and all of them are recommending the stock.

On March 24, Pacific Crest's 5-Star analyst Andy Hargreaves reiterated an outperform rating on Apple stock, and a $635 price target, writing that his "checks" of component suppliers and carrier stores suggests "iPhone unit volume could exceed our estimates of 39.7 million in March and 33.6 million in June." Hargreaves thinks "replacement rates remain extremely strong and that Apple is gaining share of high-end customers."

My Take

Apple has recorded exceptionally strong revenue and EPS growth during the last five years. The average annual sales growth for the past five years was extremely high at 35.45%, and the average annual EPS growth for the past five years was unusually high at 42.44%, only Facebook among S&P 500 tech stocks has recorded combined stronger results; average sales growth of 96.02% and average EPS growth of 64.38%. According to Yahoo Finance, Apple's next financial year forward P/E is very low at 11.60, and the average annual earnings growth estimates for the next 5 years is very high at 21.28%, these give an extremely low PEG ratio of 0.55, only Lam Research (LRCX) among S&P 500 tech stocks has a lower PEG ratio of 0.48 (see my article about Lam Research). The PEG Ratio - price/earnings to growth ratio - is a widely-used indicator of a stock's potential value. It is favored by many investors over the P/E ratio, because it also accounts for growth. A lower PEG means that the stock is more undervalued.

Apple generates lots of cash, its price-to-free-cash-flow ratio is only 14.46, and it returns value to its shareholders through dividend payments and stock buybacks. The company ended the December 2013 quarter with $158.84 billion in cash, equivalents, and long-term investments, and $16.96 billion in long-term debt, or $142 billion in net cash. Apple returned $7.7 billion in cash to shareholders through dividends and share repurchases during the December quarter. AAPL's forward annual dividend yield is at 2.26% and the payout ratio only 29%.

Apple stock is ranked sixth among S&P 500 companies, according to Portfolio123's powerful ranking system "All-Stars: Buffett". This ranking system is based on investing principles of the well-known investor, Warren Buffett, and 15-years back-test has proved that this ranking system is extremely useful.

As a devoted user of Apple products; iPhone, iPad, and iTunes, I believe, in contrast to many doubters, that Apple has not lost its ability to grow, its products are the best in the market, and exciting new products will come out soon. In my opinion, it is now a rare opportunity for a long-term investment in such a great company at a remarkably cheap price.

Arie Goren

(Why Apple Stock Is A Long-Term Investment Opportunity Right Now)

(Why Apple Stock Is A Long-Term Investment Opportunity Right Now)

freakazoid

Nuovo Utente

- Registrato

- 28/3/14

- Messaggi

- 686

- Punti reazioni

- 79

freakazoid

Nuovo Utente

- Registrato

- 28/3/14

- Messaggi

- 686

- Punti reazioni

- 79

eternauta

Novacula Occami

- Registrato

- 9/7/12

- Messaggi

- 1.979

- Punti reazioni

- 164

Trakkolo!!!!!!!!!!!!!!!!!!!!!

scusami, per cortesia sai mica che giorno del mese è oggi?

Non ho ancora trovato conferme da altre parti, qui scrivono che Tim Cook ha dato le dimissioni da ceo di apple, avete letto la notizia da qualche altra parte?

scusami, per cortesia sai mica che giorno del mese è oggi?

eternauta

Novacula Occami

- Registrato

- 9/7/12

- Messaggi

- 1.979

- Punti reazioni

- 164

chiude il trimestre sotto il 50% fibo e con un impiccato...

freakazoid

Nuovo Utente

- Registrato

- 28/3/14

- Messaggi

- 686

- Punti reazioni

- 79

L'hanging man e' una figura di inversione ribassista tra le piu' note e valide del japanese candlestick tra quelle a candela singola. Questa candela fa parte della famiglia "umbrella pattern" nome che deriva appunto dalla tipica forma ad "ombrello" che la candela esprime. L'hanging man e' formato da una lunga lower shadow e da un real body (corpo) contenuto (almeno 1/3 rispetto alla shadow). Indifferente il colore, white o black.

Questa candela diventa un segnale di inversione solo quando si trova sui massimi di un trend rialzista e gli scambi aumentano nel momento della correzione sul minimo della sessione. Cio' significa che le forze rialziste stanno esaurendo la loro spinta e sono subentrate quelle ribassiste. La situazione migliore che si puo' riscontrare e' quando l'hanging man si forma sul test di una resistenza statica o dinamica importante in presenza di ipercomprato dell' Rsi.

Una buona conferma si avrebbe se, nella sessione successiva, l'apertura fosse inferiore alla precedente chiusura. L’ultima conferma dell'inversione diverrebbe la perforazione al ribasso del minimo della lower shadow. In questo caso si afferma che si resta "impiccati" qualora si abbiano posizioni lunghe. Se dopo un forte segnale reversal si forma una candela che esprime una tendenza contraria al segnale, si deve procedere con estrema cautela prima di considerare la tendenza in corso esaurita.

Questa candela diventa un segnale di inversione solo quando si trova sui massimi di un trend rialzista e gli scambi aumentano nel momento della correzione sul minimo della sessione. Cio' significa che le forze rialziste stanno esaurendo la loro spinta e sono subentrate quelle ribassiste. La situazione migliore che si puo' riscontrare e' quando l'hanging man si forma sul test di una resistenza statica o dinamica importante in presenza di ipercomprato dell' Rsi.

Una buona conferma si avrebbe se, nella sessione successiva, l'apertura fosse inferiore alla precedente chiusura. L’ultima conferma dell'inversione diverrebbe la perforazione al ribasso del minimo della lower shadow. In questo caso si afferma che si resta "impiccati" qualora si abbiano posizioni lunghe. Se dopo un forte segnale reversal si forma una candela che esprime una tendenza contraria al segnale, si deve procedere con estrema cautela prima di considerare la tendenza in corso esaurita.

Ultima modifica:

Francino

Nada te turbe..

- Registrato

- 26/5/09

- Messaggi

- 15.927

- Punti reazioni

- 204

L'Hanging man (impiccato) è, in realtà, una figura causata dal toro che respinge in close l' attacco ribassista che, a sua volta, disegna la lower shadow.

L'hanging man, graficamente, presenta la linea del collo (base del corpo) al di sopra del top del body della figura che precede.

Segnaliamo doverosamente che, alcune figure con leggere anomalie rispetto allo standard ottimale, sono accettate dagli analisti con elasticità, perché, di solito, esse non alterano il segnale operativo.

iMATTERS - Japanese Candlestick

L'hanging man, graficamente, presenta la linea del collo (base del corpo) al di sopra del top del body della figura che precede.

Segnaliamo doverosamente che, alcune figure con leggere anomalie rispetto allo standard ottimale, sono accettate dagli analisti con elasticità, perché, di solito, esse non alterano il segnale operativo.

iMATTERS - Japanese Candlestick

freakazoid

Nuovo Utente

- Registrato

- 28/3/14

- Messaggi

- 686

- Punti reazioni

- 79

quindi?

Francino

Nada te turbe..

- Registrato

- 26/5/09

- Messaggi

- 15.927

- Punti reazioni

- 204

(parlo da uno che cerca di imparare) mi sembra che nel tuo grafo la linea del collo (base del corpo) non sia al di sopra del top del body della figura che precedequindi?