Copioincollo qui l'ultima parte della call trimestrale che non era presente nella trascrizione scaricabile dalla sezione istituzionale del sito zedge. E' la parte della call in cui si facevano domande al CEO.

Allen Klee: Hi, I’m sorry about that. Starting off with, so despite monthly active users declining, you’ve been executed on everything to really deep my top and bottom line numbers. I wanted to ask a question to start with on monthly active users. Is that — some of that is macro, some of that’s industry. Just on that one point, what would you say is what you’re working on doing that could potentially start to stabilize that?

Jonathan Reich: Hi, Allen, it’s Jonathan. Thanks so much for the kind words. In terms of MAU and stabilizing and potentially, even growing that number, literally everything that we have in our product roadmap is focused on improving that number. And in addition to that, the marketing efforts that we have, both with respect to organic, as well as paid marketing initiatives are focused on improving that number. So everything that we have talked about today, as well as our future product growth is tied to improving that monthly active user base. I just want to point out as well that we’re just slightly below 30 million monthly active users. The number is still a very, very significant number. There aren’t that many apps that I am aware of that have that sort of massive penetration. And we are certainly shooting to resume growth with that number in the upcoming corners.

Allen Klee: Yes, I would note that some industry research is saying that after smartphone sales being down for around two years, it looks like it may start — sales may start stabilizing and grow next year, which maybe that will help just that backdrop also?

Jonathan Reich: Yes.

Allen Klee: So you talk about with GuruShots and waiting with Apple’s privacy rules and waiting for the big sites like Facebook to implement what Apple has done. What are you hearing about the timing for that and when that might become effective?

Jonathan Reich: We speak to Facebook regularly. They, I think as you know, had rolled out a scan for implementation several months ago and they had to quickly roll that back. There’s no question of a doubt this is a high priority item for them, but really that question is best geared for the folks over at Meta. Having said that, we have undertaken several initiatives in order to assist in scaling our page user acquisition initiatives, including creative, and really massively increasing the number of creatives — creative themes and design and so on and so forth. As well as taking advantage of a new product that, or products feature I should say that Facebook had rolled out known as AEM, Aggregated Event Measurement, which is meant to improve performance by aggregating data from both the app or mobile space and web space.

And that, we believe, is having a positive impact as well in terms of helping us scale. So those two items together coupled with some internal work that we are in the process of undertaking in conjunction with our data team that is analyzing it’s funnel events that we believe can be targeted against are all tools that are being used in order to help us get there. But of course, once GAD4 does come out, we are chomping at the bit to include that in our marketing stack in order to increase whether it be first time depositors, users, and the like.

Allen Klee: Thank you. It sounds like you have good momentum with paint where that’s getting rolled out and how have you — talk a little about, kind of, how you think about the — how that’s going to plan of them — get it the adoption rate for that? Thank you.

Jonathan Reich: Sure. So as mentioned in my earlier comments, we’ve now made paint available on a global basis. I think a point of differentiation between us and let’s say many of the other gen AI apps that are out there is that our offering does not require a user to have to purchase tokens or subscribe to a service, but rather they can essentially paint through watching rewarded videos. And the way that we are approaching this is through several different means in terms of making sure that it is available and visible to our users, making sure that we are optimizing our store listing, but at the same point in time, maintaining our leadership position in terms of ranking with respect to mobile phone personalization. And also using the benefits of marketing automation to convert users from being consumers into actual creators.

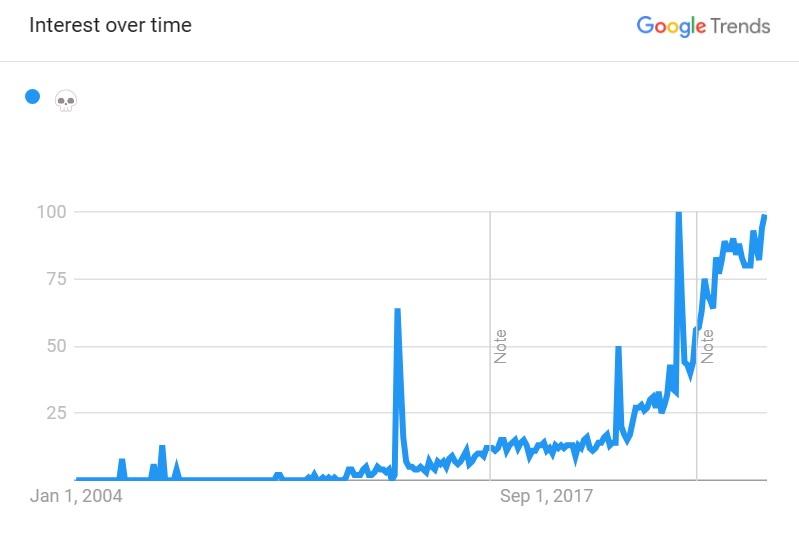

Separate and apart from all that, I think in last quarter’s conference call, I mentioned that we are working on a standalone gen AI app that we hope to release in the first couple of months of 2024 calendar year. And having a standalone fully dedicated app focused on gen AI is going to allow for us to market in ways that really free us of any focus that we have on personalization and rather shift that focus all around, you know, generative AI. So that is, in a brief nutshell, how we think about this evolving space, and we’re excited by where this space can eventually lead to. But at the same point in time, proceeding with, you know, a rational and deliberate growth plan, so that we are in better control of our destiny.

Allen Klee: Excellent. For AI Art Master, how — I went to the Google and Apple stores today, and I know they are not yet available in the U.S. But when you are launching a new game, how do you — what is the marketing strategy to try to get it to accelerate and ramp up? How are you thinking about the marketing? How to make that happen? Thanks.

Jonathan Reich: Sure. So there are many components that go into that. But let me tell you some of the things that we are currently doing, even though the game is, your point is correct, is only soft launch is available in only five countries today. Nonetheless, we’ve been investing in the AI Art Master website and that website has continued to improve its rankings in terms of search engine optimization. And that will assist in terms of driving organic growth when the game is introduced into more countries and eventually rolled out on a global basis. Separate and apart from that, we have been doing some very, very light paid user acquisition campaigns in the markets in which the game is in soft launch. Certainly, paid user acquisition will be a significant part of that business.

And then, I think it’s really critical to underscore that we will be marketing that game to our user base. So give or take 30 million monthly active users. And our users are over-indexed for engaging with casual hybrid casual type of mobile games, so that’s an additional plus. And then there is a whole set of initiatives around App Store optimization, coming up with the right collaterals in the App Store, making sure that we are benefiting from the hypergrowth that gen AI is currently experiencing. So taken together, that constitutes a good portion of our thoughts with respect to marketing this new title as we continue to progress with the soft launch.

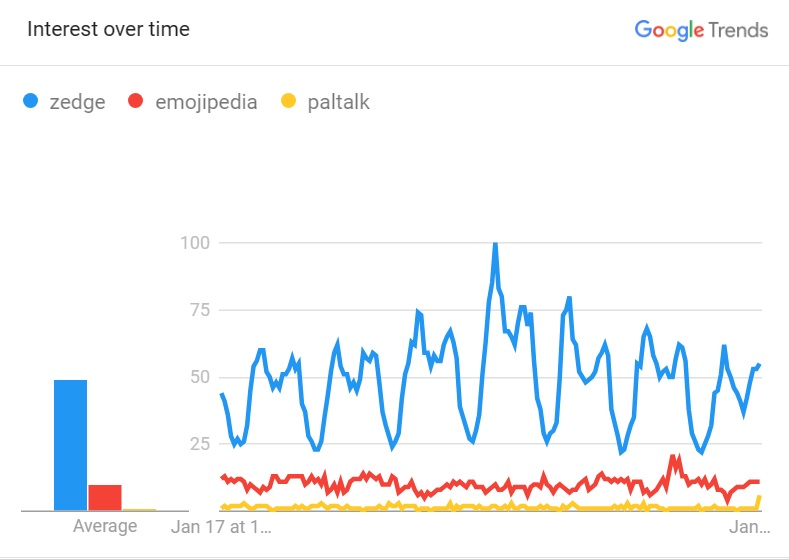

Allen Klee: Thank you. Emojipedia has been a home run. I didn’t catch everything you said of some of the new features you are looking to roll out. Could you just go over that again? Thank you.

Jonathan Reich: Sure. So we’re looking at, let’s call it an emoji translator. You can type in a field of text and you will have that text rendered in a string of emojis. We’re looking at adding new content types like emoticons. We are also in the midst of testing a print-on-demand capability where you can design…

Allen Klee : I’m sorry, what was that second? What was that second one?

Jonathan Reich: Emoticons?

Allen Klee: Yes, what is that? I’m sorry.

Jonathan Reich: Emoticons. Emoticons. E-M-O-T-I-C-O-N-S.

Allen Klee: Yes, could you explain what that is?

Jonathan Reich: It’s another form of representation of emojis, if you will. And we think that it’s a logical extension of the emoji space. So that is certainly something that we’re looking at. But just to give you an example of an emoticon, prior to emojis, if you wanted to end a email or text message with a smile, you would type in a colon and a close parentheses. That is an emoticon.

Allen Klee: Thank you.

Jonathan Reich: So to answer your question. But, you know, the notion of offering emoticons and then also offering a mashup emoji design where you can actually take two emojis and join them together and you have a new visual that is the output associated with that. So those are all areas that we’re looking at. And I would add as well that we’re also looking into the notion of offering a subscription tier to the Emojipedia service that we would want to test. And if that shows good prospects, then we would further develop that.

Allen Klee: That’s very helpful. I’ll throw in a financial question. You’re not giving specific guidance, but any commentary on how seasonality and maybe any financial metrics that you’re kind of prioritizing?

Jonathan Reich: Well, seasonality is, you know, our business is heavily weighted towards advertising revenue and we are in the same boat as any other digital business that is heavily weighted towards advertising space. Obviously RQ2, which extends November, December, January, is historically our strongest quarter of the year. And, you know, there’s no reason to believe that will be different this year. And in terms of financial KPIs, we are always looking at our cash, things like quick ratio, and then ARPMAU as being really important to the theme of being financially solvent and allowing for us to have ample runway to continue to grow the business and seize opportunity as we see that opportunity unfolding.

Allen Klee: That’s great. So I’m probably going to say this wrong, but the average revenue per monthly active user, that was up 17%. A lot of things go into that subscription definitely helped. What do you see like going forward as the key things you are doing that can impact what direction that moves in?

Jonathan Reich: Yes, so it’s a function of our product and when I say our product that involves or that includes not only our ad stack and how we monetize our ad inventory, but also our subscription offering. As you’ve seen, the growth and subscription space has sustained for, I guess, two quarters. Subscriptions, the introduction of subscriptions on iOS are really exciting. They are at higher price points when compared to Android. So that coupled with the Zedge premium marketplace, where we actually go out and allow for artists to sell licensed content and how that is priced and how that is offered to our user base, all of those taken together contribute to influencing that average revenue per monthly active user.

Allen Klee: Okay, great. That’s it for my questions. Thank you very much. Congratulations on a strong quarter.

Jonathan Reich: Thank you.

Operator: We have no further questions in queue. This concludes our question-and-answer session and conference call. Thank you for attending today’s presentation. You may now disconnect.